Issuing licenses

Information on obtaining license for payment institutions, electronic money institutions and payment system operators

1. Payment institutions and electronic money institutions

Payment services and electronic money issuance can only be performed by trade companies that are being licensed by the National Bank to perform this type of activity. Obtaining a permit is a licensing process that the National Bank carries out in order to assess the fulfilment of the legal requirements for performing payment services/electronic money issuance, the suitability of the members of the management bodies and the owners with qualified holding, as well as the ability of the company to ensure continuity and reliability in the performance of services and protection of the users’ interests. Therefore, the National Bank ensures that all participants entering the market are stable and financially viable, with their bodies having professional competence and reputation. This process includes submission of an application and appropriate documentation, which is further subject to inspection and analysis by the National Bank. After receiving the permit, the payment service providers are subject to constant on-site and off-site supervision, which examine the compliance of the operation with the legislation.

The National Bank encourages everyone interested in obtaining a license to contact the National Bank and show interest in submitting an application for obtaining a license. We are open to cooperation and providing detailed information to potential applicants about the licensing process and all other factors that may affect this process.

Before starting the licensing process, it is recommended that the applicant make certain preparatory activities to ensure that it meets the legal requirements and at the same time hold an initial meeting with the representatives of the National Bank to get answers to all issues that could arise during the preparation of the application and documentation. Some of these activities include at least:

- Verification of the legal requirements that regulate the issuance of a license and the performance of payment services/issuance of electronic money – Law on Payment Services and Payment Systems and by-laws;

- Representation of the ownership, organizational and management structure - the applicant should provide information about its organizational units, about the owners of the company and the management bodies;

- Presentation of the business model, which should contain the details about the payment services type it plans to perform or the issuance of electronic money, the way it will perform these services, as well as the financial forecasts for the next 3 years;

- Description of the management system, which implies presentation of the internal control systems;

- Setup of the information system.

During the first meeting with the representatives of the National Bank, it is recommended that the above information be given in advance in the form of a presentation.

The next step is to submit a formal application for a license for providing payment services/issuance of electronic money. In order to submit the application, the applicant must first be registered as a trade company in the Republic of North Macedonia, with initial capital in the monetary form recorded as core principal, in an amount that depends on the type of payment services it intends to render or the electronic money it intends to issue.

Together with the application for obtaining a license for providing payment services/issuing electronic money, documents, data and information provided for by the Law on Payment Services and Payment Systems and the by-law ‒ Decision on issuing licenses and approvals to payment institutions and electronic money institutions and on the contents and the manner of maintaining registries shall also be submitted.

At the following link, a short presentation is available, which elaborates the basic requirements of the Law and the by-laws that need to be fulfilled for obtaining a license for a payment institution or an electronic money institution and the regulatory reports as a reporting system that needs to be established.

( Law on Payment Services and Payment Systems (LPSPS))

Law on Payment Services and Payment Systems (LPSPS))

For all information and questions related to the payment institution/electronic money institution licensing process, please visit: [email protected]

2. Payment systems operatorsA trade company can operate a payment system only if obtained a license for payment system operator from the National Bank. Obtaining a license for a payment system operator is a process that the National Bank carries out in order to assess whether the applicant fulfills the conditions for performing the activity of a payment system operator prescribed by law, the suitability of the members of the Management Board, i.e. the executive members of the Board of Directors, the persons who acquire qualified holding, the adequacy of the rules for the operation of the payment system, as well as the ability of the company to ensure stable, reliable and efficient operation of the payment system. This process includes submission of an application for obtaining a license for a payment system operator and corresponding documents, data and information, which are further subject to verification and analysis by the National Bank. After receiving the license, the payment systems operators are subject to constant on-site and off-site supervision, which checks the compliance of the payment systems operations with the international standards for the payment systems operations prescribed by the legal and by-laws.

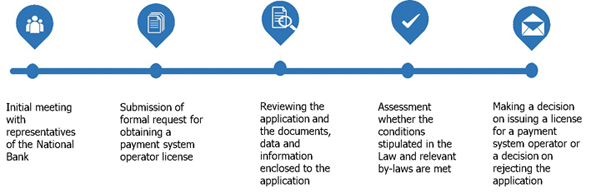

Before submitting an official application for obtaining a license for a payment system operator, it is recommended that the applicant do certain preparatory activities in order to secure the appropriate documents, data and information and at the same time, hold an initial meeting with the representatives of the National Bank in order to discuss the business plan and the services it intends to offer to the market. This will allow the applicant to gain a better understanding of the regulatory environment, as well as the procedure for obtaining a license, while providing the National Bank with a better understanding of the applicant's business model and ownership, organizational and management set-up. In this manner, it is possible to clarify certain dilemmas and issues that may arise during the preparation of the application and the corresponding documents. During the first meeting with the representatives of the National Bank, it is recommended to give certain information in advance in the form of a presentation. Some of this information includes at least:

- Verification of the legal requirements that regulate the issuance of the license for the payment systems operator prescribed by the Law on the Payment services and Payment Systems and by-laws thereof;

- Presentation of the ownership, organizational and management structure - the applicant should provide information about its organizational units, the company owners and the members of the management bodies;

- Presentation of the business plan for the payment system operator activity, which should contain a comprehensive description of the previous activity, data on the type of payment instruments that will be used to perform payment transactions in the payment system, as well as the plan for budget development and planning with financial forecast for the first three business years;

- Description of the management system, which includes the internal control system and

- Information system setup.

The next step is to submit a formal application for a payment system operator's license. In order to submit the application, the applicant must first be registered as a joint-stock company in the Republic of North Macedonia, with initial capital in monetary form recorded as the core principal, in the amount of at least Denar 7,800,000.

The documents, data and information stipulated by the Law on Payment Services and Payment Systems and the Decision on issuing licenses and approvals to payment system operator and the contents and the manner of maintaining registries of payment system operators shall be enclosed to the application for a license for performing the activity of a payment system operator

A short presentation elaborating the basic requirements of the Law and the by-laws that must be met for obtaining a license for a payment system operator is given below.

( Procedure for obtaining a payment system operator license)

Procedure for obtaining a payment system operator license)

The National Bank encourages anyone interested in obtaining a license to contact the National Bank and express interest in submitting an application for obtaining a license. For all questions and necessary information regarding obtaining a license for a payment system operator, please contact the following e-mail address: [email protected]