External Debt

External debt of an economy represents actual current liabilities between residents and non-residents, based on debt instruments, at a certain date. The statistical research of the external debt includes standard reports for Gross External Debt and Gross External Claims.

The most used external debt indicator is the gross external debt, which at any given time is the outstanding amount of current and not contingent liabilities that require payment(s) of principal and /or interest by the debtor at some point(s) in the future and that are owed to nonresidents by residents of an economy.

External debt statistics also include indicators for net external debt i.e. the difference between the stock of gross external debt and gross external claims. In its structure, net external debt is identical with the gross external debt and claims, where the standard presentation contains classification by institutional sectors, maturity and debt instruments.

Latest developments:

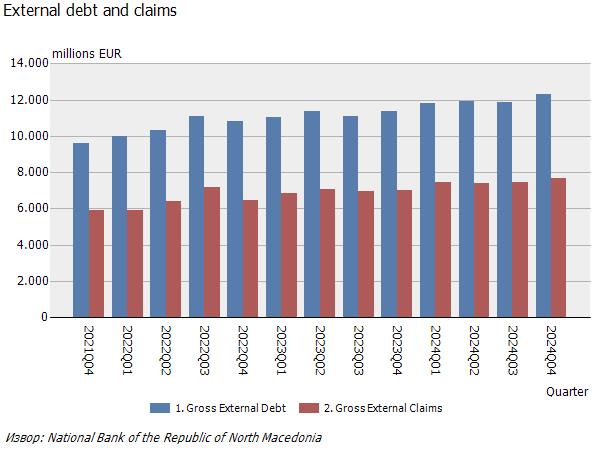

At the end of December 2024, the gross external debt amounted to Euro 12,320 million (or 79.9% of GDP for 2024) which is a quarterly increase of Euro 449 million, while gross external claims increased by Euro 265 million and equaled Euro 7,690 million (or 49.9% of GDP). The larger quarterly increase in liabilities against claims led to a growth of the net external debt by Euro 183 million, and at the end of December 2024 it amounted to Euro 4,630 million (or 30% of GDP). The increase in the net external debt in the fourth quarter stems from the higher private net debt of Euro 328 million, given a decrease in the public net debt of Euro 144 million. Read more...

Archive on External Debt

For more detailed information on the released statistical data, please contact us at [email protected] or+389 2 3215 181 ext.103 (or 110/108)