International Investment Position

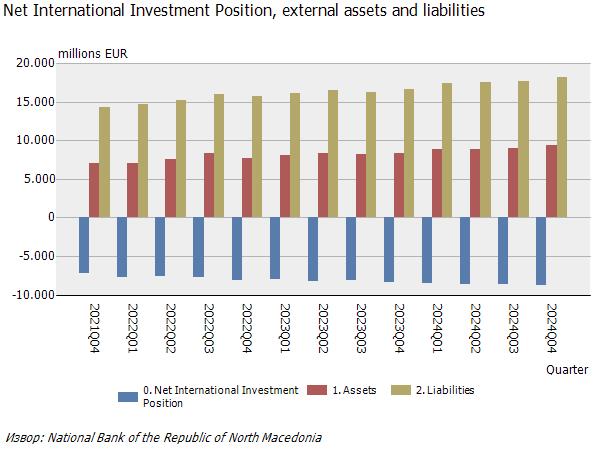

International investment position (IIP) presents the stock and structure of external financial assets and liabilities vis-à-vis non-residents based on financial instruments, on a specific date.

The difference between the total international financial assets and liabilities presents the net-international investment position of a country. Thereby, negative net international investment position means that financial liabilities exceed the financial claims on non-residents.

Latest developments:

At the end of the fourth quarter of 2024, the negative net international investment position amounted to Euro 8,767 million, or 56.8% of the GDP for 2024. On a quarterly basis, the negative IIP increased by Euro 193 million, resulting from the more intensive increase in liabilities relative to the increased assets.

Observed by instrument, the net liabilities based on debt instruments increased by Euro 183 million, while net liabilities based on equity instruments increased by Euro 9 million. Read more...

Archive on International Investment Position

For more detailed information on the released statistical data, please contact us at [email protected] or+389 2 3215 181 ext.103 (or 110/108)