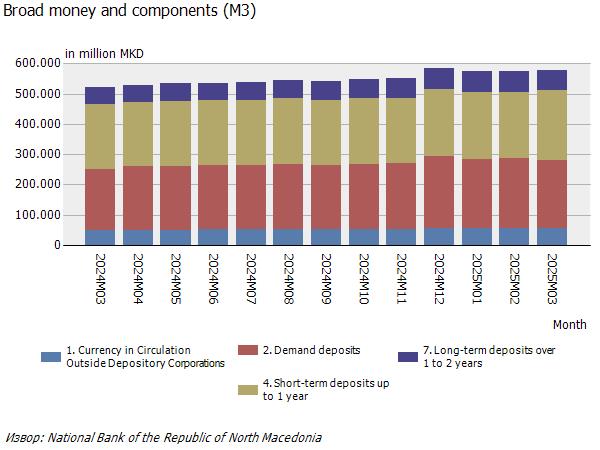

Мonetary Aggregates- Broad Money and Components

Broad money М1 includes the currency in circulation and demand deposits. Broad money М2 (liquid assets) includes the monetary aggregate M1 and the short-term deposits. Broad money М3 (standardized definition of broad money) includes the monetary aggregate M2 and long-term deposits with maturity from one to two years. Broad money М4 (total deposit potential of the monetary system) includes the monetary aggregate M3 and long-term deposits with maturity over two years, in Denars and in foreign currency. The broad money M3 is an internationally agreed definition of the money supply of the Republic of North Macedonia.

Deposits and Loans at Banks and Saving Houses

Deposits of the non-government sector at banks and savings houses include demand deposits (current accounts), sight deposits, overnight deposits, time deposits and restricted deposits. Deposits are presented by sector, currency and maturity structure.

_________________________________________________________________________________

Latest achievements:

In March 2025, the broad money (monetary aggregate M3) registered a monthly growth of 0.6%. Annually, the increase equaled 10.9% and resulted from the increase in demand deposits, short-term deposits, long-term deposits up to two years and currency in circulation.

In March, total deposits grew quarterly by 0.6%, entirely due to increased corporate deposits. Annually, the total deposits increased by 12.7%, which stems from the higher deposits in both sectors, with a more pronounced contribution of household deposits. See more...

_________________________________________________________________________________

Archive for Мonetary and Credit Aggregates

For more detailed information on the released statistical data, please contact us at [email protected] or+389 2 3215 181 ext.116 (or 110/108)