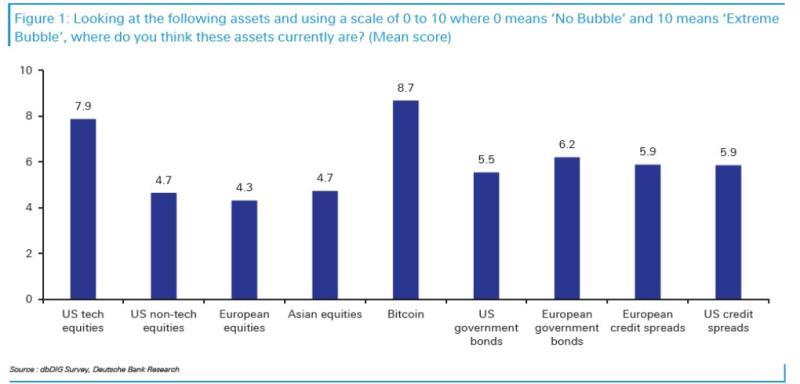

Investing in cryptoassets is generally considered high risk. The high risk that individuals investing in cryptoassets take, comes from the high volatility of their market price, which is significantly higher compared to the volatility of other financial and non-financial assets, such as foreign exchange rates of the sovereign currencies , stock returns or prices of commodities traded on global markets (for example, oil). This means that there can be significant changes in the market price of cryptoassets in a short period of time, both upwards and downwards. For example, historically analyzed, the market price of Bitcoin has registered daily changes above the usual market daily changes in stock indices or stock prices, which are usually one-digit. In addition, various studies indicate the risk of the so-called bubble in the market price of cryptoassets. For example, the following chart shows the answers of the respondents who are professional market participants in the financial markets, on which assets at the beginning of 2021 are at the highest risk of registering the so-called bubble in the dynamics of their market price. As can be seen, for the Bitcoin, as the most popular cryptoasset, on a scale from 0 to 10, where 10 is a score for "extreme risk of bubble", the highest average score of 8.7 was registered.

In addition, the global cryptoassets market is quite heterogeneous, as proved by the fact that there are almost 7000 cryptoassets, which differ in the way they are created or the purpose for which they are issued. But at the same time, the global cryptoassets market is quite concentrated, which is confirmed by the fact that the market capitalization of the largest cryptoasset is about 68% of the total market capitalization of all cryptoassets, with the top ten cryptoassets by market capitalization represent about 90% of the total market capitalization of all cryptoassets (as of the first half of January 2021). A specific risk, both from a regulatory and investment aspect, is the collection of funds from the general public investments through initial coin offerings (ICOs) for financing certain projects, in order to circumvent the effective regulatory requirements for the implementation of initial public offerings (IPOs) of financial instruments.

Therefore, everyone who invests should be extremely careful and well informed about the potential implications of their investments. They should be aware that the value of cryptoassets can also be zero.

In addition, it should be noted that when investing in cryptoassets, individuals are exposed to numerous operational risks and other risks of losing their property, especially in conditions of development of a large number of public or private decentralized infrastructures which the possession of cryptoassets and their non-regulation on a global scale are based on. Given that the issuance, investment and trading in cryptoassets depend on computer systems and software, cyber risks as well as possibilities for the hacking attacks are significant. In addition, the high level of anonymity in the possession of certain cryptoassets, as well as in the conduct of transactions with cryptoassets, increases the risk of money laundering and terrorist financing. This increases the risk that certain platforms will be temporarily or completely blocked and customers' digital wallets may be frozen as a result of measures taken by anti-money laundering and terrorist financing authorities or financial crime investigators. Financial institutions may also refuse to carry out payment transactions related to investment in cryptoassets, if they consider that such transactions expose them or their clients to a high level of risk of money laundering or terrorist financing.

The National Bank urges potential investors to be careful and to make difference between digital currencies that can be issued by central banks (CBDC) and cryptocurrencies issued by private entities, whose value is pegged with the value of a certain sovereign currency (stablecoins). Regarding stablecoins, despite the fact that their value is "covered" by certain pool of currencies, it is always issued by private entities, according to their rules. Because of this, investors should be careful not to mislead or have false expectations, given the similarity of the names and / or characteristics of these two types of digital assets, and thus expose themselves to the potential risk of fraud. (back | back to Q&As about cryptocurrencies)